Calculating Your Coffee Shop Break-Even Point

Your Coffee Shop Break-Even Point

To make money, you have to spend money, right?

But when does spending money turn into actually making money?

That special moment is called your break-even point.

One of the most challenging aspects of starting any business, including a coffee shop, is developing a budget and financial forecast that estimates your profitability. This is especially true if you have decided to start a coffee shop from scratch and no available data exists.

In this post, we will give you a brief overview of calculating your coffee shop break-even point, why it's important, and how you can use it to make better decisions that impact your coffee shop's financial health and profitability.

What is a break-even point?

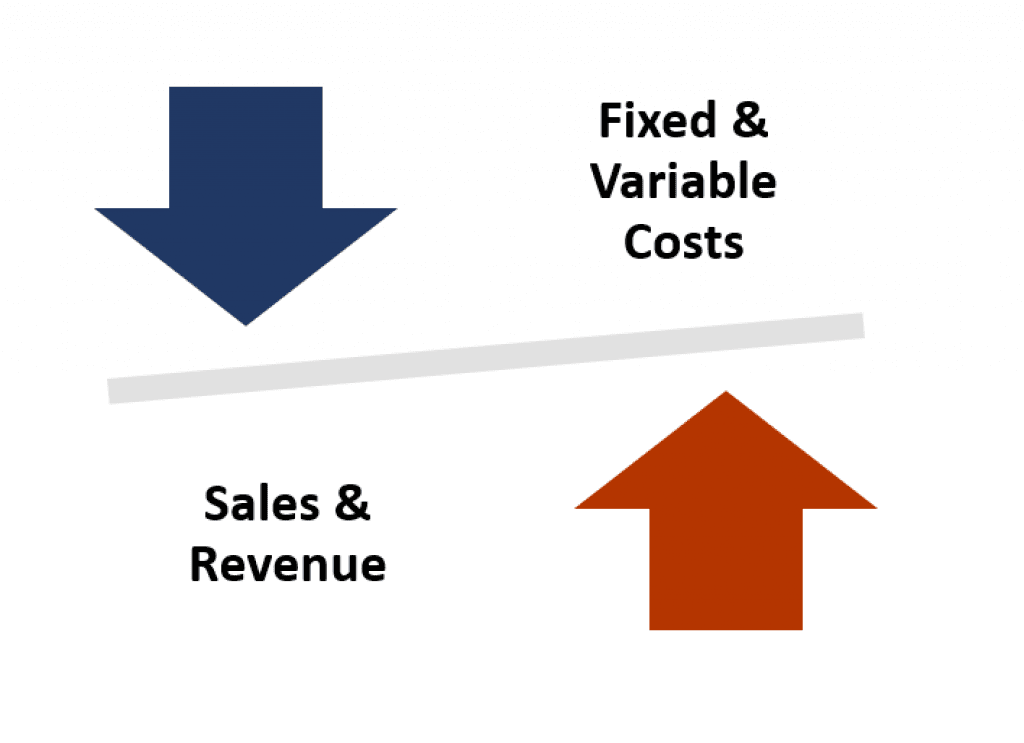

Your coffee shop break-even point is the moment in time when your total costs are equal to your revenue. Anything below your break-even point, and you are operating at a loss. Anything above your break-even point constitutes a profit. When you reach your break-even point, the operations of your business have covered your fixed and variable costs.

Consider the break-even point graphic below:

Why is knowing your break-even point important?

Your coffee shop break-even point is an important financial finish line. It separates you from the point of losing money to making money. Knowing the point at which you “cross over” to profitability is vitally important to the health of our business.

By knowing our financial status, we can make managerial changes to boost our revenue and decrease costs. For example, you might decide to charge higher prices on your coffee or muffins, eliminate certain inventory, or cut back on barista hours, etc.

You might also enter a property lease situation where you must give your physical space owner or manager a certain percentage of your profit margin.

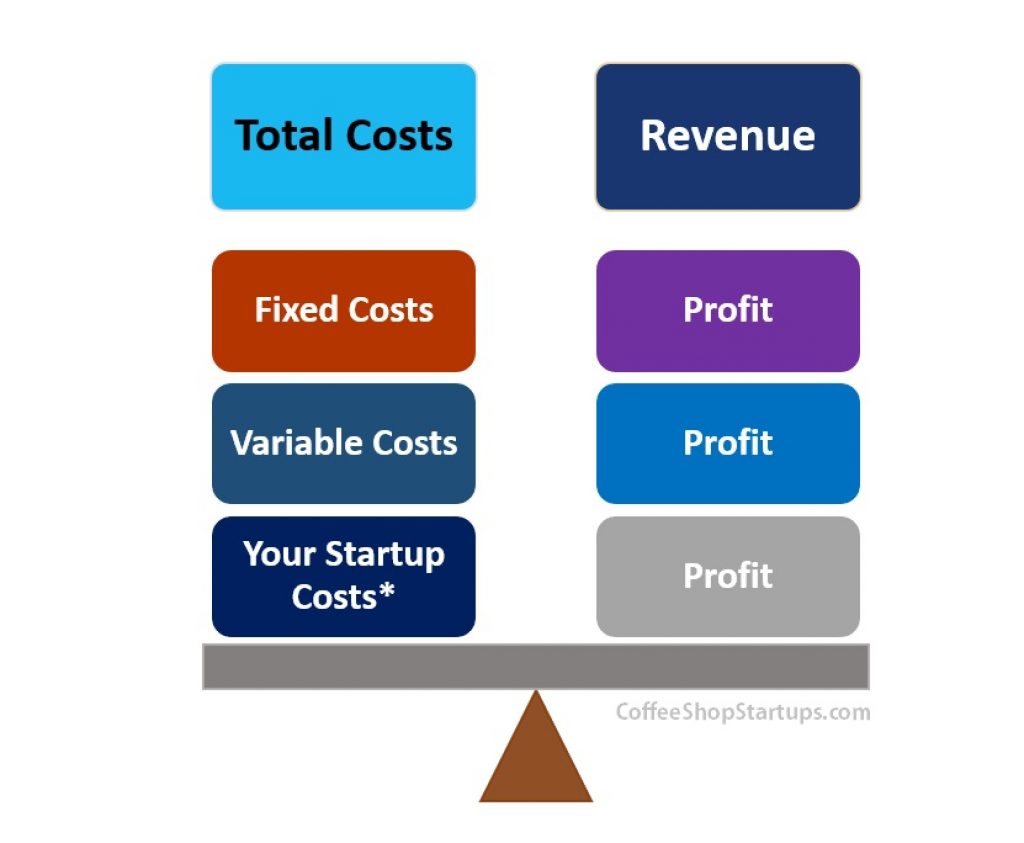

Let's look at another similar graphic:

Your sales and revenue will eventually exceed the natural costs incurred by your coffee shop business operations. This will be your break-even point.

Defining Your Coffee Shop Break-Even Point

While the common definition of a break-even point is when costs and revenue equal each other, other factors may determine how you define your break-even point.

You may decide to include your coffee shop startup costs in the equation.

For example, let’s say you borrow $10,000 to start your coffee shop business. Would your break-even point be reached once you paid off this loan? Or would you define your break-even point as simply your total current operational costs versus your current revenue?

A common way of determining a break-even point is using your variable and fixed costs against your net revenue. But this may give you a false sense of profit if you still own money. While many large companies calculate without the startup costs, I think it's worthwhile to figure out your break-even point with the costs you had to start your business. You will have to determine what makes more sense for you.

So, let’s talk about our coffee shop startup costs below:

Other Coffee Shop Business Articles:

| Coffee Shop Ideas & Concepts | Coffee Shop Budget and Planning |

|---|---|

| 50 Coffee Shop Ideas & Concepts | 7 Ways to Open a Coffee Shop with No Money |

| Low-Cost Coffee Shop Ideas | Open a Coffee Shop Bookstore |

| How to Open a Drive-Thru Coffee Stand | How Much do Coffee Shop Owners Make? |

Coffee Shop Break-Even Point

How Much Money Does It Take to Open a Coffee Shop?

The answer to how much money it takes to open a coffee shop is not always straightforward. In reality, several factors actually dictate the costs of setting up a new coffee business.

The costs of opening your coffee shop will depend on your concept, menu items, location, and other variables.

To dive deeper into this topic, read our post, How Much Does it Cost to Start a Coffee Shop?

Let’s briefly discuss a typical cost breakdown:

Coffee Shop Startup Costs May Include:

- Real-estate costs

- Broker fees

- Coffee equipment costs

- Build-out & remodeling costs

- Permits and Licenses

- General liability insurance

- Logo & marketing work

- Taxes

- Barista training & payroll

- Other one-time costs

Once your coffee startup costs are determined and paid for, it will take money to run the actual day-to-day business. We call these costs operational costs. Operational costs are associated with running your coffee shop daily or month-to-month. These are the costs that are typically associated with calculating a break-even point.

Determining Our Break-Even Point

You will need several key pieces of information to create the financial plans needed for your coffee business.

- Your Startup Costs

- Operational Costs

- Revenue Projections

If you are starting a brand-new coffee shop from scratch, you’re obviously not going to have these numbers. You will need to find estimates. I recommend developing realistic, not very conservative, numbers to plug into these projections. If you are buying an existing business, you will want to see the current and past sales history.

Your Coffee Shop Break-even Point

A Sample Coffee Shop Startup Scenario

For the sake of this post illustration, let’s briefly outline some coffee shop startup cost estimates for a new coffee shop. We’ll use them throughout the rest of this post as our example.

For the sake of this post illustration, let’s briefly outline some coffee shop startup cost estimates for a new coffee shop. We’ll use them throughout the rest of this post as our example.

For a more detailed analysis, read our post, Understanding the Cost of Starting Your Coffee Shop.

For now, let’s consider your costs:

- Legal and Administrative: $300

- Coffee Equipment Costs: $12,000

- Remodeling and Buildout: $4,500

- Furniture and Fixtures: $2,500

- Other Costs: $2,500

Initial Total Startup Costs: $21,800

For the sake of simplicity, let’s assume that you borrowed nearly half of the amount – This would be $10,000 plus interest that you would finance. You’ve agreed that your monthly payment would be $350.

Okay, great; we’ve taken care of our initial startup costs, but we’re not quite done.

Next, let’s figure out our estimated operational costs per month. Your operational cost for your coffee shop has two parts: fixed and variable costs.

Fixed costs are costs that are fixed, such as your monthly rent or your insurance premiums. Variable costs go up or down depending on your business activity. For example, if you sell more coffee, you’ll need more coffee, milk, and cups. These costs change over time.

Again, below you have a super-simplified list illustrating both of these:

Coffee Shop Operational Fixed Costs

- Rent: $2,000

- Insurance: $300

- Loan & Interest: $350

- Your Fixed Salary: $4,200

Total monthly fixed cost total: $7,200 (Daily fixed cost: $240)

Coffee Shop Operational Variable Costs

- Labor costs: $1,200

- Coffee: $650

- Milk: $450

- Baked goods: $300

- Other costs: $200

Total Monthly variable cost: $2,800 (Daily variable cost: $93.33 = 2,800/30 days)

Total Operational Costs: $10,000 (Fixed and Variable Costs)

*Your personal daily salary: $140 ($4,200 per month)

The average Total Daily Cost is $333

*Note: You can choose to give yourself a fixed salary or take your money from your profits. Both have state and federal tax ramifications, so check with your state government tax office.

Next, let’s determine your sales projections.

Your Coffee Shop Break-even Point

Determine Your Coffee Shop Sales Projections

Your sales projections are critical to determining your estimated break-even point for your coffee shop.

To open a new coffee business, you must estimate the sales volume. You will also have to estimate the price of an average receipt.

Let’s consider that you anticipate steady foot traffic and sales throughout the day at your chosen coffee shop location. A local college, a nearby bank, and several popular boutiques drive up a lot of foot traffic in the area.

Let’s say that you estimate an average of 12 transactions per hour for 10 hours at this location. Also, assume that your average sale or customer check for your coffee business is $4.35 (coffee and cookie).

This is what the equation would look like:

(Average Sale Receipt) X (Average Transactions per Hour) X (Hours)

= Gross Revenue

OR…

$4.35 (Average Sale Receipt) X 12 (Average Transactions per Hour) X 10 (Hours) = $522 Gross Revenue

This is your (sample) average projected sales PER DAY for your coffee business.

Sample Coffee Shop Monthly Revenue Average:

$522 X 30 days = $15,660

Again, if you are a new coffee business, you may experience more or fewer daily transactions, but you won't know until you open your business.

However, you can determine your estimated numbers by either counting customers, looking at neighboring businesses, or getting the receipts for an existing business.

Nevertheless, $522 per day sounds pretty good. You can't just hit the town with $522 in your pocket!

After all, you will need to subtract your expenses. As mentioned, you will be subtracting your fixed and variable costs. You might also have to repay other one-time expenditures that were needed to start your business.

Therefore, your daily expenses will be subtracted from your daily sales. You may use your monthly or daily sales numbers to calculate your margins.

Again, these costs may include:

- First and One-Time Startup Costs

- Ongoing Fixed Costs (Rent, Insurance, Security)

- Ongoing Variable Costs (Coffee, Supplies, Labor)

Stay with us on this example:

For the sake of this illustration, let’s say you have calculated that your average daily cost per day, including a salary that you are paying yourself, would be an estimated average of $333 per day.

$240 (Fixed Cost) +$93 (Variable Costs) = $333 (Total Fixed & Variable)

$522 – $333 = $208 Net Revenue

The total sum of $208 may be considered your daily profit. Will this be enough to sustain your business?

Well, it might be.

In this scenario, you’re making a profit. That’s good. But have you then passed your break-even point?

Perhaps.

The fact is that under this same scenario, you are not done paying your loan off completely. Additionally, you will have to determine how the money that you personally invested in your business gets paid back to you.

Increasing Your Coffee Shop Sales

If you are concerned that you need to make more money to be profitable, you can consider a few options.

For example, to raise your income, you may do a couple of things:

- Increase the number of transactions (get more customers)

- Increase the sale price per receipt (get existing customers to buy more).

Again, you can boost your numbers by either getting more customers, up-selling, or raising your prices.

You can also take a look at your expenses and figure out where you might be able to tighten your costs (cost restructuring). To learn more about increasing coffee shop sales, read our post, How to Increase Your Coffee Shop Sales.

Determining Your Break-Even Point With Single Menu Items

You might decide to offer a variety of items for sale on your coffee shop menu board. How would you know if you are making a profit on those items?

Like the illustration above, you must add the costs and subtract them from your unit price. Doing so for each item may be lengthy, but it may help you develop your overall pricing strategy if you completely break down the costs.

Since we’re focused on a coffee shop, let’s consider the cost of selling a cup of coffee (an Americano or a Vanilla Latte). How much would it cost you to sell 100 cups of coffee? We’ve detailed the cost of selling 100 cups of coffee here, and in general, we believe it’s a good way to break down all the costs associated with your sales.

For example:

Cost for 1 Americano:

- $.50 coffee

- $.27 cup, lid, & sleeve

Total Cost for One Americano (no milk): $.77

Sale Price: $2.75

Your Margin $1.98

This does not include equipment, rent, insurance, or labor costs. This is strictly the cost of making a cup of coffee. It is useful to determine the costs of making specific menu items in this way. It helps to determine the barebones cost of your items and decide whether or not these are acceptable margins to cover your other expenses.

Your Coffee Shop Break-even Point

Related Questions:

Why is my coffee shop break-even point important to determine?

It helps your coffee shop assess its overall cost structures. It determines how much coffee (or revenue) you need to make in order for you to cover the costs and move into profitability.

Your break-even point analysis is often first determined while writing your coffee shop business plan. But as you can imagine, assessing your break-even point regularly is critically important.

Your break-even point also helps you look at your coffee shop pricing strategy. Do you need to charge more for your current menu items? What items can you add to improve the profit margins for your coffee shop?

What's the best way to determine my coffee shop break-point?

The first step in determining your break-even point is to analyze the cost of your entire operation. While you also want to determine the costs of each item, it may be more helpful and less cumbersome to set your profit margin to a particular ratio. For example, you may decide to simply double everything. If you buy a wholesale bagel or muffin for $1.00. You will sell it for $2.00.

Determining your break-even point means figuring out your cost with one item. However, in a coffee shop, you are selling multiple products – each with its own different profit margin. Therefore, you may want to add up all of your costs (fixed and variable costs). Next, determine how many sales you will need to cover your cumulative costs.

To start calculating your break-even point (with startup cost included):

- Add up all of your startup costs

- Decide on how long you wish to pay off these total startup costs

- Divide by the number of months you wish to pay off your total startup costs (i.e. 3 years = 36 months)

- Estimate Your Monthly Fixed Costs

- Estimate Your Monthly Operational Costs

- Add up your fixed, variable, and monthly startup costs

- Estimate Your Monthly Sales

- Estimate Your Sales Margin

Next:

Fixed Costs ÷ Sales Margin = Break-Even Point (sales dollars) =

Gross Sales Revenue – Variable Costs = Sales Margin

Whichever method you decide, I recommend staying consistent and make sure all of the costs are included.

Trending Articles on Coffee Shop Startups:

| Coffee Shop Ideas & Concepts | Coffee Shop Budget and Planning |

|---|---|

| 50 Coffee Shop Ideas & Concepts | 7 Ways to Open a Coffee Shop with No Money |

| Low-Cost Coffee Shop Ideas | Open a Coffee Shop Bookstore |

| How to Open a Drive-Thru Coffee Stand | How Much do Coffee Shop Owners Make? |

Your Coffee Shop POS System Can Help

There are a variety of methods that you can choose to calculate your coffee shop break-even point. Whichever way you decide to go, one thing remains the same:

You need data.

One of the ways to determine your data is to have a robust coffee shop POS system like Lightspeed POS or something similar. Read our Coffee Shop POS article here. Your POS can help you determine your sales numbers – as well as provide insight into your inventory costs, labor costs, etc.

![]()

Are You Ready To Get Started?

Unlock Your Dream Coffee Shop Business with Our Exclusive Coffee Shop Startups Kit!

Ready to transform your passion for coffee into a thriving business? Look no further! Our Coffee Shop Startups Kit is your key to brewing success. Here's why you can't miss this opportunity:

![]() 35-Lecture Coffee Shop Business Course: Our kit provides a comprehensive A-to-Z lecture series that covers what you should know and how to plan your coffee business. No more guesswork – follow our proven roadmap for success.

35-Lecture Coffee Shop Business Course: Our kit provides a comprehensive A-to-Z lecture series that covers what you should know and how to plan your coffee business. No more guesswork – follow our proven roadmap for success.

![]() Comprehensive Coffee Shop Business Guide: Our kit includes a detailed, step-by-step guide that takes you from creating your concept to your grand opening.

Comprehensive Coffee Shop Business Guide: Our kit includes a detailed, step-by-step guide that takes you from creating your concept to your grand opening.

![]() Expert Interviews and Insights: Benefit from insider tips and industry secrets that successful coffee shop owners and experts share during one-on-one interviews. Learn from the best to stay ahead of the competition.

Expert Interviews and Insights: Benefit from insider tips and industry secrets that successful coffee shop owners and experts share during one-on-one interviews. Learn from the best to stay ahead of the competition.

![]() Business Essentials: We provide business plan templates, checklists, and resources to streamline your startup process. From permits to menu planning, we've got you covered.

Business Essentials: We provide business plan templates, checklists, and resources to streamline your startup process. From permits to menu planning, we've got you covered.

![]() Cost-effective Solutions: Save time and money with our expert advice and budgeting tips. Maximize your ROI and minimize headaches.

Cost-effective Solutions: Save time and money with our expert advice and budgeting tips. Maximize your ROI and minimize headaches.

![]() Adaptable to Any Setting: Our kit is designed to suit various locations and customer demographics, whether you're eyeing a trendy urban spot or a cozy corner in a suburban neighborhood.

Adaptable to Any Setting: Our kit is designed to suit various locations and customer demographics, whether you're eyeing a trendy urban spot or a cozy corner in a suburban neighborhood.

Includes Exclusive BONUS Material!

👉 Order Now and Begin Your Journey!

Don't let the complexities of starting a coffee shop overwhelm you. Our Coffee Shop Startups Kit is your ticket to entrepreneurial success. Take the first step towards owning a profitable and fulfilling coffee business today.

Join the thousands of successful coffee entrepreneurs who started with a dream and a great plan. Your journey to coffee shop greatness begins right here!

Comprehensive. Proven. Affordable.

The Complete Coffee Shop Startup Kit

(Instantly Delivered To You)

* The information on this page is for educational purposes only. We do not offer legal advice.