How to Develop Your Coffee Shop Funding Mix

Coffee Shop Funding Mix

How to Develop Your Coffee Shop Funding Mix

Coming up with a Plan to Pay for Your Coffee Shop

So, you want to start a coffee shop? Yes, of course, you do!

So, you want to start a coffee shop? Yes, of course, you do!

You might already have a fantastic idea for a coffee business, except… you are not sure how you will pay for it!

There is no question that money will often be the most significant barrier to getting your coffee shop up and running.

So, how are you going to pay for your coffee shop?

In today’s post, I’m not going to spend too much time on the obvious – that starting a coffee business with little money can be challenging but possible.

Instead, I want to focus on understanding the general categories of the typical coffee shop startup costs; and how you can develop a framework to figure out how to pay for it.

This framework will describe various pools of capital to fund your future coffee shop business. Our aim is to show you how to find the money to start your coffee business without going broke. If you are stressing about the money, let’s all take a collective deep breath and keep reading.

![]()

Funding Your Coffee Shop

How Will You Pay for Your Coffee Business?

The most important part of starting a coffee shop is getting enough money to pay for the coffee startup costs and its operational costs until it is self-sustainable – or paying for itself.

A large part of paying for your coffee shop is understanding just how much money you need to get started.

Often, people shy away from truly understanding the costs to avoid them altogether.

But that strategy never works.

It’s best to dive in – and figure out all your coffee shop startup costs and your framework for funding your coffee shop.

Different Costs with the Same Goal

First, you will want to know the differences among the types of costs associated with starting your coffee business. From there, you can formulate how you will pay for it.

First, you will want to know the differences among the types of costs associated with starting your coffee business. From there, you can formulate how you will pay for it.

To come up with a funding plan for your coffee shop, you need to:

- Write your coffee shop business plan

- Determine your coffee shop startup costs

- Develop a funding mix

- Secure the funding plan

The first two items on the list, we’ve discussed previously in great detail. Therefore, we won’t discuss them much here.

It’s best to begin with writing your business plan to articulate your vision and path toward opening.

Your vision, in many ways, will dictate your startup costs. Once you know how much your coffee shop will cost – and why – you’ll be ready to create your coffee shop funding mix.

For the sake of this article, let’s assume that you have already written a coffee shop business plan and have determined the costs associated with your coffee shop startup. Next, you will want to focus on developing your funding mix and securing your funding.

For more information, read:

For more information, read:

How to Start Your Coffee Shop Business Plan

The Costs of Starting a Coffee Shop Business

If you haven’t started your business plan yet, that’s okay. Knowing your funding mix may give you a better perspective and secure your capital.

Trending Articles on Coffee Shop Startups:

| Coffee Shop Ideas & Concepts | Coffee Shop Budget and Planning |

|---|---|

| 50 Coffee Shop Ideas & Concepts | 7 Ways to Open a Coffee Shop with No Money |

| Low-Cost Coffee Shop Ideas | Open a Coffee Shop Bookstore |

| How to Open a Drive-Thru Coffee Stand | How Much do Coffee Shop Owners Make? |

Your Coffee Shop Startup Costs

To summarize, there are two general categories of coffee shop costs:

- actual startup costs

- operational costs

Your startup costs include such things as your legal and administrative costs, café build-out, and installation of coffee equipment, furniture, and fixtures. In addition, you may have initial barista training, marketing and branding, and contractor work that needs to be accounted for.

Coffee Shop Startup Cost Examples:

- Legal & administrative fees

- Build out

- Branding

- Equipment

- Training

- Furniture & fixtures

- Contractor work

Operational costs typically come after you open your coffee shop. They are composed of your rent, utilities, insurance, inventory, and labor. Operational costs will be broken down further into fixed costs and variable costs.

Coffee Shop Operational Cost Examples

Fixed costs examples

- Insurance

- Rent

- Interest payments on loans

- Managerial salaries

Variable costs examples

- Labor

- Coffee

- Milk

- Utilities

After writing your coffee shop business plan and developing your coffee shop budget, you will understand all the costs of starting your coffee shop.

One of the essential estimates is your coffee shop break-even point. Knowing your break-even point will help you determine how much money you will need in reserves.

Keep in mind that you will not start turning a profit on the first day. Your earnings will most likely be used up to pay for your startup costs and other one-time costs that are typical for a new business.

Therefore, you will need to have funds to see you through until your business is self-sufficient. That is, you need enough cash to keep you afloat until your business makes enough money to pay for itself. So, be sure to include this extra reserve of money in your financial estimates.

Note: It is vital for retail businesses like coffee shops to have sufficient liquid funds or cash to pay for inventory, salaries, and labor. Without it, your business will grind to a halt.

So now that you know your costs, let’s break down how you will pay for it. Let’s create a coffee shop funding mix!

Paying for Your Coffee Shop

What is a Coffee Shop Funding Mix?

After years of discussing how to fund a coffee shop, we’ve coined the term Coffee Shop Funding Mix.

Your “coffee shop funding mix” is a simple but powerful framework that spells out your source of money.

It details where you will get your funding – and from whom. It’s an important tool to help you break down your access to money in a manageable and realistic way.

Coffee Shop Funding Mix Elements

Your Specific Mix – Each element represents a pool of available (or potential) money that you can use to fund your coffee shop business. You can use one, two, or all of these potential “pools of funds.” You will want to ensure the funding mix adds up to 100% or more of what you need. In the planning stages, these percentages will only be estimated by financial pools.

To start, write down every potential pool that you can use to fund your coffee shop. Each of these sources of cash in your funding mix may have pros or cons. You will have to determine the advantages or disadvantages that are inherent to each part of the mix. Below, we will list the most common pools of funding.

Also, be aware of the timing that you will access these pools. For example, a coffee shop may hold off on investing in a coffee roaster for the first two years after they open or until they are ready to move forward.

Further Reading: How to Start a Coffee Shop Successfully

![]()

Coffee Shop Funding Mix Pools

Personal Savings

You may want to utilize your savings as the first installment of your funding mix. For example, you may wish to secure 20% of the total cost of your coffee business startup estimates through your personal savings account and then branch out to the other pools. It may be essential for you to put in some savings as a commitment to your project. It also shows others that you have a stake in your coffee business.

Advantage: You can quickly fund a significant percentage of your business and have access to seed money quickly. It also provides funding to do your initial research and planning.

Disadvantage: Using significant savings might put you in a challenging personal financial situation.

Personal Loans

Personal loans from family and friends are a common way to open a business. Many independent companies open up this way.

Personal loans from family and friends are a common way to open a business. Many independent companies open up this way.

When borrowing money from family and friends, I strongly recommend you write up a loan contract detailing how much was borrowed, when, and how you will pay the funds back.

Additionally, it should be explicitly written if any interest or collateral is involved in the loan. This will help keep things clean and transparent and avoid any conflict with the people closest to you.

Advantage: You can forgo the formalities of credit checks and high-interest payments. Your relatives and friends might be more willing to lend you money and have a lower interest rate than banks or investors.

Disadvantage: Asking family or friends may cause tension, disagreement, or conflict. (And the risk of ruining Thanksgiving or family get-togethers is high!)

Coffee Shop Business Loans

A bank or financial institution usually provides business loans. Often, some coffee entrepreneurs may utilize the bank that they already have an established account with.

Before making an appointment with your loan officer, it will be essential to write a detailed coffee shop business plan or proposal. The proposal will detail how much money is needed and what it will be spent on.

Advantage: A straightforward loan provides terms that are agreed upon upfront so that there are no surprises for the lender or borrower.

Disadvantage: Business loans may have higher interest rates, penalties for late fees, and require collateral – and greater financial scrutiny. Business loans may take time to acquire and require lots of time, preparation, and paper work for each institution.

Home Equity Loans

A home equity loan is where you pull money out of the equity of your home. Essentially you are borrowing against your home. Depending on the amount of money you owe on the initial mortgage, this route may or may not be ideal. You should consult your family and an accountant before moving forward. If you are “underwater” on your mortgage; That is, if your mortgage is worth more than your house; you will not have any equity from which to borrow.

Advantage: A home equity loan is a relatively easy way to get money for your business.

Disadvantage: Depending on the terms of your loan, you will extend the life of your home equity loan. You may incur penalties for non-payment or late payments. By going this route, you are quite literally betting on the farm. A loss significant loss could lead to the possibility of losing your home.

Partners and Co-Owners

You may have partners or co-owners who bring money to the table. Some partners may be “silent partners,” while others may play a more significant role in your business decision-making and operation.

It is advisable to have a contract which offers details about how much money is given to the business and what is exchanged for the funds. For example, would there be a specific percentage of ownership, managerial rights, profit-sharing, decision-making, etc.?

Advantage: You can utilize the savings of your partners and co-owners without undergoing the traditional requirements of getting a loan. Bringing in partners also provides other resources – other than money. These resources may be experience, talent, equipment, knowledge, or contacts.

Disadvantage: Shared decision-making may lead to conflict. A business may be torn by being led into too many directions.

Investors

It is common for some investors to look for small businesses to invest in. Investors may have several demands, including what items are sold, who you hire, marketing efforts, and other business decisions. Additionally, these terms may include specific collateral, decision-making power, interest, and a percentage of the revenue.

Advantage: Investors can give you the cash and additional support you need while avoiding the disadvantages of going to the bank or borrowing from friends and family. They may also have the flexibility to step in and offer additional financial support if you need it.

Disadvantage: Investors may want to have decision-making power or add other terms to their liking. This may include a percentage of the revenue or profits.

Credit Cards:

We are all familiar with credit cards. They are super easy to use to pay for things quickly. While utilizing credit cards to pay for elements of your coffee shop, we strongly urge caution.

Advantage: Easily accessible to money.

Disadvantage: It may have limits and high-interest rates. Typically, it’s not a good idea to fund any business solely on credit cards.

Crowdfunding

Crowdfunding is an emerging way to get money for your coffee shop business. It can be a significant part of your overall funding mix. On the whole, crowdfunding has opened up the possibilities of funding for many companies and should be considered a serious pool of funding opportunities. It will take work to promote your crowdfunding effort, but it may be well worth it.

Advantage: You can utilize your fan base, friends, family, and strangers to contribute to your cause.

Disadvantage: It can take a lot of time and effort to promote your crowdfunding campaign. It is common for people to spend considerable money on their campaigns. Additionally, you may not be able to raise the anticipated funds. You will have to pay a percentage of your funds earned to the platform you are using.

Your Coffee Shop Funding Mix

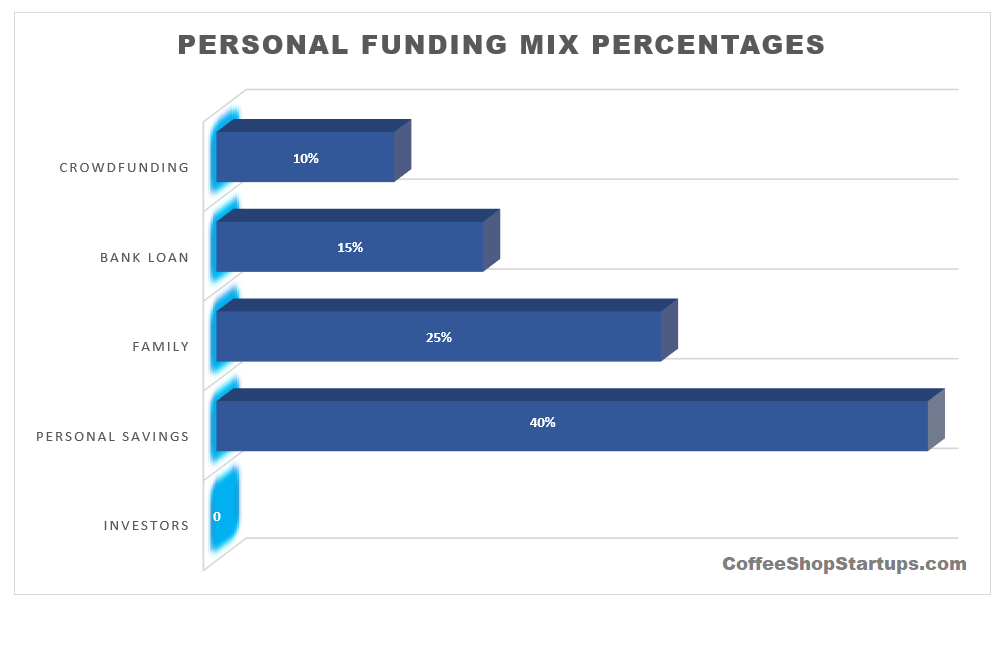

There is no question that every coffee shop will have a different funding mix. Every coffee shop startup will have its own unique funding arrangement.

The following graph may be a typical scenario:

Next is coming up with a plan to get money from each pool that makes up your specific mix.

Strategies for Your Coffee Shop Funding Mix

Personal savings

We all have finite savings. So, you will need to consider how much of your savings you will put towards your coffee business. It would need to be at a level that you feel comfortable with, allowing you to feel financially stable.

Strategy: Choose the amount of personal funds you can put towards your business and deposit it into your business account.

Loan From Family & Friends

It would be best to write your business plan before approaching other people for money for your coffee business. Writing your business plan will help you better discuss what you want and how much you need.

It would be best to write your business plan before approaching other people for money for your coffee business. Writing your business plan will help you better discuss what you want and how much you need.

Be tactful when approaching friends and family. I suspect that most friends and family don’t want to say NO to you. So, feel things out before you ask and be tactful. For example, asking a family member who struggles to make ends meet or a friend who just lost his house may not be a good idea.

Your friends and family are counting on you to have a plan. The chances are that they can’t afford to lose the money they loan you. Always offer a contract – even if they say no. Provide, in writing, the details on how much you are borrowing, when you will pay it back, and any terms such as interest, payment schedules, or late fees.

Strategy: Write a list of friends of the family that you believe are in a position to lend money. Write your coffee shop business plan and make a copy for them.

Determine how much money you would need and what interest you may give in return. Draw a sample contract out and be prepared to negotiate. Additionally, be prepared for them to answer NO. If they decline your offer, don’t have any hard feelings towards them. If they do say yes, present your plan and your contract and ask if there is anything they would like to add to it.

Business Loans

A business loan from a bank or institution will likely require a business plan and possibly some collateral. If you plan on getting a business loan for a new business, you will most likely have your past credit checked. So, make sure you clear up any institutional debt or outstanding payments you owe. Be aware of your credit score or any outstanding obligations.

Have your business plan ready and be able to answer how much money you need and why.

Strategy: Write a business plan and draw up a proposal. Don’t be afraid to be rejected. Other banks may be willing to help if you get declined by the first bank.

Home Equity Loans

Home equity loans may be a sensitive subject because it involves putting up your home as collateral. Before pulling money out with an equity loan or a line of credit, make sure you understand the terms.

Strategy: Talk to your mortgage officer – and possibly your accountant – and see if a home equity loan will work for you.

Partners and Co-Owners

Getting involved with partners and co-owners can be tricky. Before approaching a potential co-owner or partner, be sure – I mean, be really sure – that you can go into business with this person or persons.

Ask yourself:

- Can I work with this person(s)?

- Are they familiar with the coffee business?

- Do they like coffee?

- Do they have previous business experience?

- Is this person trustworthy?

- Does this person have a strong work ethic?

- Is this someone that will work to resolve issues?

- Can they be a team player?

Strategy: Be honest and truthful with your gut feelings. Trust your intuition. Either way, you will want to draw up a contract. Additionally, ensure that there is a way to get out of the contract for both of you, such as what needs to happen for the agreement to be terminated. Since we don’t offer legal advice, you may want to speak to a business attorney to draw up a contract.

Investors

Like the other funding mix options, you want to make sure your coffee shop business plan is written. Additionally, you want to have a detailed plan of what kind of investor you would like. Be discriminate. Not every investor is worth your business. Ask yourself the same questions as noted above. If you feel unsure or hesitant, then re-think who you bring in to invest in your business.

Strategy: You may have a shortlist of people or companies you may want to approach. Have a proposal and a business plan readily available. Meet with potential investors and hear what their requirements are.

Credit Cards

I wouldn’t say I like using credit cards as a long-term solution to paying for anything, especially a business. Credit card bills can quickly balloon, and interest rates can get out of control. As a result, credit cards should only be used as a simple convenience tool that will get paid off at the end of the month.

Strategy: Avoid as much as possible using your credit cards to fund your business. Utilize cards as an option to pay for small things or services conveniently. Try to pay credit card debt off monthly.

Crowdfunding

Crowdfunding can be an effective way to raise money for your coffee business. But it’s a funding option that you will have to really work for.

Strategy: For your crowdfunding campaign to succeed, you will want to develop a way to promote it online. Often a video and social media strategy will play a significant role. Since crowdfunding may or may deliver the funds you need, it may be wise not to entirely depend on this type of funding for your coffee shop.

Read our article, Funding Your Coffee Shop Through Crowdfunding

What Will Your Funding Mix Look Like?

I recommend sitting down and writing down each of these potential funding pools. Write down a realistic percentage that you may believe you can achieve. Keep in mind that you may either get more or less from each pool, so you may need to recalibrate your funding as you move forward or as the actual funds start coming in.

Alright, so now that you’ve come up with your funding mix. You want to take the following steps:

1 Write your business plan

2 Make sure you include your anticipated budget

3 Create your funding mix

4 Develop a proposal for each funding mix element

![]()

Are You Ready To Get Started?

Unlock Your Dream Coffee Shop Business with Our Exclusive Coffee Shop Startups Kit!

Ready to transform your passion for coffee into a thriving business? Look no further! Our Coffee Shop Startups Kit is your key to brewing success. Here's why you can't miss this opportunity:

![]() 35-Lecture Coffee Shop Business Course: Our kit provides a comprehensive A-to-Z lecture series that covers what you should know and how to plan your coffee business. No more guesswork – follow our proven roadmap for success.

35-Lecture Coffee Shop Business Course: Our kit provides a comprehensive A-to-Z lecture series that covers what you should know and how to plan your coffee business. No more guesswork – follow our proven roadmap for success.

![]() Comprehensive Coffee Shop Business Guide: Our kit includes a detailed, step-by-step guide that takes you from creating your concept to your grand opening.

Comprehensive Coffee Shop Business Guide: Our kit includes a detailed, step-by-step guide that takes you from creating your concept to your grand opening.

![]() Expert Interviews and Insights: Benefit from insider tips and industry secrets that successful coffee shop owners and experts share during one-on-one interviews. Learn from the best to stay ahead of the competition.

Expert Interviews and Insights: Benefit from insider tips and industry secrets that successful coffee shop owners and experts share during one-on-one interviews. Learn from the best to stay ahead of the competition.

![]() Business Essentials: We provide business plan templates, checklists, and resources to streamline your startup process. From permits to menu planning, we've got you covered.

Business Essentials: We provide business plan templates, checklists, and resources to streamline your startup process. From permits to menu planning, we've got you covered.

![]() Cost-effective Solutions: Save time and money with our expert advice and budgeting tips. Maximize your ROI and minimize headaches.

Cost-effective Solutions: Save time and money with our expert advice and budgeting tips. Maximize your ROI and minimize headaches.

![]() Adaptable to Any Setting: Our kit is designed to suit various locations and customer demographics, whether you're eyeing a trendy urban spot or a cozy corner in a suburban neighborhood.

Adaptable to Any Setting: Our kit is designed to suit various locations and customer demographics, whether you're eyeing a trendy urban spot or a cozy corner in a suburban neighborhood.

Includes Exclusive BONUS Material!

👉 Order Now and Begin Your Journey!

Don't let the complexities of starting a coffee shop overwhelm you. Our Coffee Shop Startups Kit is your ticket to entrepreneurial success. Take the first step towards owning a profitable and fulfilling coffee business today.

Join the thousands of successful coffee entrepreneurs who started with a dream and a great plan. Your journey to coffee shop greatness begins right here!

Comprehensive. Proven. Affordable.

The Complete Coffee Shop Startup Kit

(Instantly Delivered To You)

* The information on this page is for educational purposes only. We do not offer legal advice.