How to Fund Your Coffee Shop

Disclaimer: We don't issue legal or investment advice. The information is for educational purposes only.

How to Fund Your Coffee Shop

Preparing to Fund Your Cafe

We’ve all walked into our favorite café and imagined what it would be like to own a coffee shop.

You can imagine your espresso machine whirling milk, the sound of music playing, the aroma of roasted coffee filling the air…your customers laughing, or having their first date… it all seems magical and exciting.

Then we start thinking about money.

Or lack of it.

The reality hits home. Do we wonder how much money it will take to start our dream coffee shop?

The truth is that realizing your coffee shop often comes down to whether or not you’re able to secure enough money for coffee business startup expenses.

How will you pay for your coffee shop startup?

Whether you want to open a coffee shop, set up your mobile coffee truck, or start a drive-thru coffee stand, you must have enough money to set up your coffee business until it’s financially sustainable.

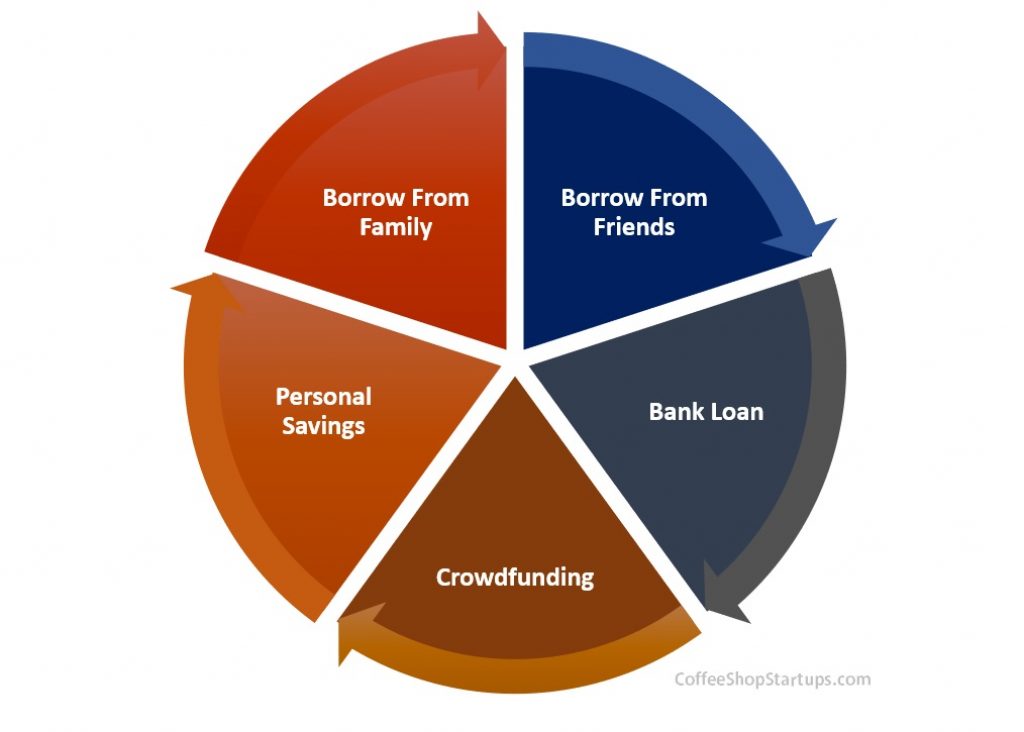

There are several main ways to finance a coffee business:

There are common ways to fund your coffee shop business. They are listed below:

There are common ways to fund your coffee shop business. They are listed below:

- Personal savings

- Bank business loan

- Personal loans from family and friends

- Consumer credit cards

- Crowdfunding

- Silent investors

- A combination of all of these

There are advantages and disadvantages to each of these listed above. You must consider your specific personal circumstances and financial priorities before deciding on any of the options mentioned.

Aspiring coffee business owners will often decide to move forward with a business loan or personal loan as a primary funding source for their coffee business.

They may also decide to have a coffee business funding mix from the beginning. Your funding mix is essentially the various percentages some of these options will play in setting up your coffee business. For example, your coffee shop funding mix might be a combination of personal savings, business loans, credit cards, and crowdfunding.

Preparing For a Loan to Fund Your Coffee Shop Business

In this post, I will discuss how you might better prepare for taking out a loan (regardless of type) for your coffee business.

Whether you decide to take out a business bank loan, borrow from investors, or take a personal loan from friends and family, we hope the following tips will help put you in the best possible position to succeed.

Funding Your Coffee Shop

![]()

How To Prepare To Fund Your Coffee Shop

1. Understand your coffee shop concept

A well-developed coffee shop concept is a central priority before asking to borrow money from anyone.

For example, do you want to open a traditional coffee shop? If so, what will be your central theme, your interior cafe design, and what will be on your coffee shop menu? You need to know exactly what you want to accomplish with your coffee business before approaching investors.

Perhaps you are thinking about setting up a drive-thru coffee stand. In this case, your physical location is of critical importance. I recommend doing your traffic research in advance and having estimated sales projections ready for your investors.

Or you might be on the cusp of moving forward with buying a used trailer that you will convert into a coffee trailer. Mobile coffee businesses are prevalent nowadays. This is a great idea if you have limited funding and want to reach profitability sooner.

Take the time to figure out what coffee business makes sense for you right now. Do the initial research and then decide. Once you decide on your business concept, start writing a coffee shop business plan.

2. Write a coffee shop business plan

Your coffee shop business plan will help you flesh out all the thoughts, coffee shop concepts, and ideas into one cohesive plan.

A coffee shop business plan not only saves you time and money in the long run but will ultimately help you secure funding from your lenders.

Most competent lenders and investors will want to see a written business plan (on paper) that details your concept and pathway toward opening your coffee shop and the potential for profitability.

Lenders want to see that you have done your homework and thought through each detail of your plan.

Why do lenders want to see your business plan?

Ultimately, they don’t want to lose their money. They want to make money. They want you to make money. Your success is their success. A competent business plan tells them how you plan to be successful.

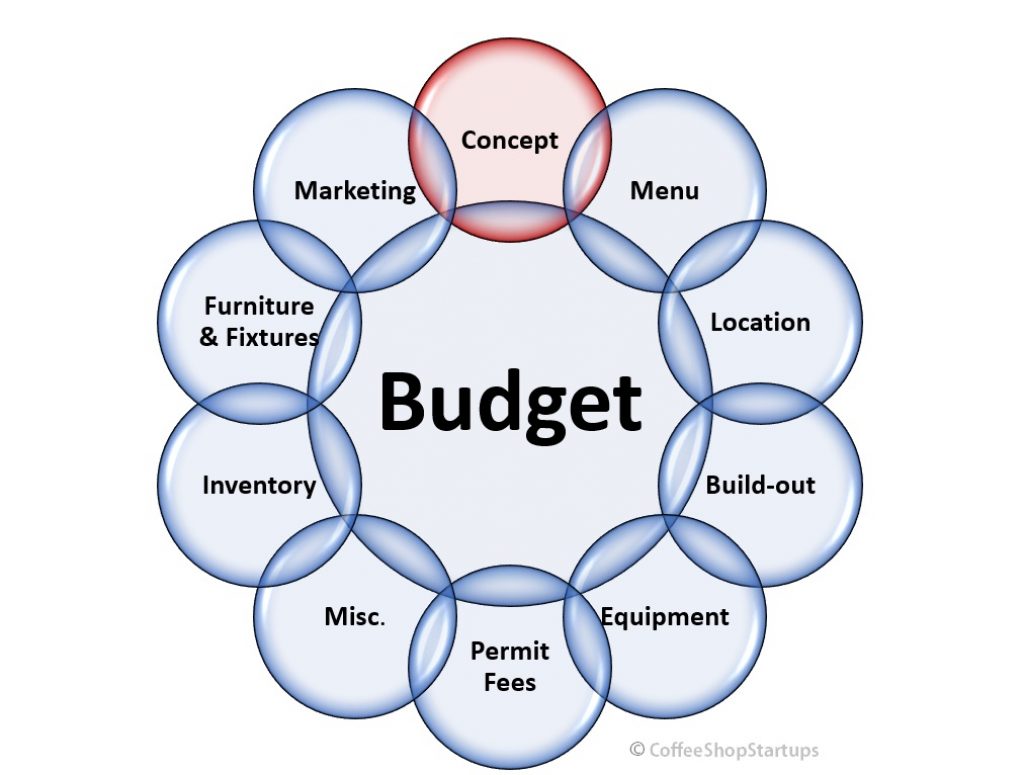

3. Develop a sensible coffee shop budget

Depending on what coffee business concept you settle on, you’ll have different business expenses.

You will want to write down all of your anticipated costs and expenses – based on your coffee shop concept – and keep them in a working file. To do this, you will have to do some initial research. Along with your startup costs, it would be best to determine your fixed and variable costs. These might slightly change as your business plan changes, but it will give your lenders the most objective picture.

For example, what’s the cost of a two-group espresso machine? Will you need a commercial blender? Will you need to have plumbing installed in your truck or trailer? What is your hometown's real estate market like, and how will it impact your rent?

Additionally, you will want to know your estimated projections and determine just how much money you can expect to make as a coffee shop owner.

Developing a coffee shop budget will play a key role in determining how much money you will need to finance. This leads us to our next point.

Having a reasonable coffee shop budget will be important for your lenders. They want to see that you won’t waste their money – you’ve thought everything through and have a high chance of success.

4. Know how much money you need to borrow

In developing your coffee shop concept, writing your business plan, and sketching out a fair budget, you will see a financial picture emerge.

Adding up the estimated expenses will give you a cost range you want to look at. After examining the cost of starting your coffee shop concept, does it look feasible to you? Do you need to realign your concept with your anticipated budget?

You might want to consider where you can reduce costs.

For example, let’s say you decide to open a drive-thru coffee stand. You realize that the total startup costs will be about $19,000.

By knowing your personal financial situation, you will have a better picture of how much money you can contribute and how much you will need to borrow.

Let’s say you have $9,000 in savings set aside for your drive-thru coffee stand. You also want to make sure that your funds won’t impact your and your family’s well-being, health, and financial stability. If you feel comfortable about parting with your money – and not having it impact your family – only then should you continue funding this way.

In this scenario, you will need to borrow at least $10,000.

You might want to give yourself extra funds in case you go over budget. Let’s focus on $10,000 as the number to borrow.

Tip: Keep track of coffee business expenses:

Although you might only be in the initial planning stages of opening your coffee shop, you will want to keep track of any expenditures in your future coffee business.

For example, I bought my first commercial coffee grinder before I started my first coffee shop. I left it on my kitchen counter as an inspiration to keep saving, keep researching, and keep my coffee shop dream alive!

It also served as a big reminder that I needed to keep a file – a manila envelope, to be exact – and I tracked all my expenses.

While you will want to speak to an accountant, you will want to save receipts so that you can expense those purchases on your tax filing when it comes time.

How to FundYour Coffee Shop

Advantages of Borrowing from Friends and Family

Before borrowing money from a lending institution such as a bank, you might decide to borrow money from friends and family. Your immediate circle can make your dream of starting a coffee shop one step closer. In many ways, obtaining this money for your coffee shop might be considered easier. There are some key advantages of personal loans made by family and friends.

Consider the following:

Your family members don’t need to be rich

Family members don’t need to be rich to lend you money. However, they do need to have the financial stability to lend money without jeopardizing their own well-being. Your family members may be able to give what they can without sacrificing their financial stability. Borrowing from several family members and friends might be enough to launch your coffee business.

Greater Flexibility

Borrowing from friends or family can allow you to develop flexible – but agreed upon – scheduling or repayments. You may be able to work out an unorthodox payment schedule, but it may leave both parties in better financial shape than a traditional payment agreement.

Lower Interest Rates

Borrowing from your family can reduce the interest rates and any associated fees you may get when taking out a bank loan. However, the agreed-upon loan may offer your family a higher interest rate than they would normally get if leaving their money in a low-yielding savings account.

Maintain Federal Tax Deductions

Borrowing money for your business may still allow you to take your interest payments as a tax deduction. It would be best if you talked to a tax professional about the tax specifics.

Other Notes:

Sometimes, borrowing money from family and friends can trigger familial history and the stirring of emotions. You want to make sure that you approach the right family members and friends – and carefully not breach their trust or love for you.

If you are thinking about borrowing money from family and friends, you’ll want to make a clear loan agreement in writing. Spell everything out – in writing – and always live up to your end of the loan agreement. Businesses come and go, but family members are forever.

How to Fund Your Coffee Shop

Considerations Before Seeking a Loan

Taking out a traditional business loan from a banking institution will require you to submit various forms and information. Knowing the main elements that most banks will be checking on is a good idea. Your information will most likely be verified through credit bureaus, bank statements, and payroll stubs.

A business loan officer will want to see your coffee shop business plan and possibly a business proposal to decide. Additionally, they will look at the following:

- Your current income

- Your existing debt

- Credit score

- Any outstanding bills or liens against you

- Previous business credit rating

If you are approved for your business loan, you will want to understand a few basic elements before signing it. You may want to consult an accountant or attorney for more specific information.

However, with that said, you will want to pay attention to the following:

Understand The Terms of Loan

Whether you borrow from friends, family, or a banking institution, you want to understand the terms of your business loan. Terms will spell out in specificity everything you agree to. It will detail the ability to pay the loan off early. It will detail any late fees or what happens if you default on your loan.

You will want to be familiar with the following terms:

The Principal – This is the exact amount you are borrowing. In the above scenario, you would borrow $10,000. This would be considered your principal.

Interest Rate – This is the cost of borrowing the principal and is often determined by percentage points. Your interest can vary depending on the type of lender you are working with and what is deemed to be your creditworthiness. For example, if you have a past issue on your credit report for missing credit card payments, you may be assigned a higher interest rate.

Term of Loan – The term of the loan refers to the time period that the loan will be agreed to. For example, you might have a 3-year loan, a 5-year loan, etc. Often, the loan term is detailed in months. So a 2-year loan would be noted in 24 months; a 3-year loan will be noted in 36 months, and so on.

The total cost of the loan – The total cost of the loan will or should be noted. This will include a breakdown of the principal and compound interest payments. So, for example, on a $10,000 loan, you may pay back $11,500. You will need to agree to a payment amount, along with a schedule that works for you.

Amortized Scheduled Payments

Amortized payments blend your principal and your interest in a payment schedule divided over time.

For example, let’s say you decide to borrow $10,000 from your Uncle Jack. You decide to pay him back over three years or 36 months at a 5% interest rate. Additionally, you also agree to give him an additional $50 for every month you are late.

These terms, as specified, work out for you and your uncle just fine.

In summary, your family coffee business loan looks like this:

- Principal Amount of loan: $10,000

- Interest rate: 5.0%

- Term: 3 years (36 months)

When you do that math, your monthly payments to Uncle Jack will be about $300 or ($299.71, to be exact). Your total interest payment would be about $790. Your total loan repayment will be $10,790. Some institutions also charge several fees in addition to your interest, so be sure to understand what those fees are.

![]()

Advantages and Disadvantages of a Bank Business Loan

When notorious bank robber Willie Sutton was asked why he robbed banks, he responded, “Because that’s where the money is.” And that’s why most of us borrow money from a bank at some point in our lives.

While you might consider the option of borrowing from family and friends first, as noted above, banks often are the most rational choice.

Getting an institutional business loan for your coffee shop has its pros and cons. Let’s briefly discuss a couple of them below.

Advantages of securing a bank loan:

It has the cash for your coffee business – a bank will provide you with the cash you need. Whether you need $5000 or $100,000, a bank may be able to provide you the needed funds you can’t get anywhere else.

No need to borrow from friends and family – sometimes borrowing money from an institution is a lot easier (emotionally and financially) than borrowing from your family members. If these go south with your coffee business or loan, you don’t have to worry about souring relations with your family members.

Develop business credit – borrowing from a bank can allow you to develop business credit for future growth and expansion. Having good business credit could help you secure future loans at better rates.

Disadvantages of securing a loan:

You may need to revisit your credit history – times can be unpredictable. A job loss and a few missed payments can lead to a lower credit score and higher interest rate. Your credit history may indicate the bank's need to give you a higher interest rate and limit the funds you can borrow.

Your bank may not be flexible to your situation – after the terms are signed and agreed to, your bank will expect a payment every month. Regardless of whether or not you can work, banks expect repayments of loans. A missed loan payment and you will not only be facing a ding on your credit history, higher fees, etc.

Once you get your money, what should you do with it?

Having a business loan with agreeable terms could help you launch your coffee business. Once you receive your money, you should already have a plan in place to use it appropriately.

Using your money wisely is possible only if you plan your coffee budget thoughtfully.

One of the best ways to plan out your coffee business is to hear directly from experienced coffee business owners. We’ve created one of the most convenient and comprehensive ways to learn about starting your coffee shop business. With over 15 hours of one-on-one interviews, you’ll learn about the topics that concerned most coffee shop owners as they started their coffee business.

Your Coffee Shop Funding Mix:

Finding The Money to Open Your Coffee Shop

In this article, we spent some time discussing the preparation for your coffee shop loan. While business loans are common for a significant number of retail coffee businesses, it is not the only means of funding.

In fact, here at Coffee Shop Startups, we refer to the general sources of money to start your coffee shop as a funding mix. Having a diverse or deep funding mix may be a positive way to fund your retail coffee operation.

We’ve detailed the funding mix in our articles, How Much Does it Costs to Start a Coffee Shop? Additionally, consider reading Seven Ways to Start a Coffee Shop with No Money.

Let’s briefly review the essence of your funding mix. Think of your funding mix as various streams of available funding resources. These resources could be diverse and offer various levels of funding opportunities.

A funding mix may include:

- Personal Savings

- Borrowing from friends and family

- Borrowing from a lending institution

- Bringing in investors

- Working with partners

- Crowdfunding

- Starting a coffee co-op

Your “funding mix” may include all or just one of the available streams of potential sources of money. In your business plan, you will want to detail your funding mix and how much you intend to borrow from a bank or other institution.

It is recommended that you determine your entire funding mix before approaching a bank or even friends and family. Having a well-written business plan will help you obtain the money you seek to open your coffee shop.

Ready to Get Started?

Start Your Dream Coffee Shop Business

Starting a coffee shop is exciting, but it can also feel overwhelming. Where do you start? What steps should you take? How do you avoid costly mistakes? That’s where the Professional Coffee Shop Startups Kit comes in. It’s designed to give you a clear, practical roadmap to opening a successful coffee business—without wasting time or money on guesswork.

Inside, you'll find:

![]() Expert interviews with real coffee shop owners and business experts.

Expert interviews with real coffee shop owners and business experts.

![]() An On-Demand 37-lecture course covering everything from business planning to daily operations.

An On-Demand 37-lecture course covering everything from business planning to daily operations.

![]() Editable coffee shop business templates, financial documents, checklists, and planning tools to keep you on track.

Editable coffee shop business templates, financial documents, checklists, and planning tools to keep you on track.

![]() A step-by-step startup guide that walks you through concept development, permits, branding, and more.

A step-by-step startup guide that walks you through concept development, permits, branding, and more.

![]() Cost-saving strategies to help you launch your coffee business on a budget.

Cost-saving strategies to help you launch your coffee business on a budget.

Whether planning a small coffee cart or a full-scale café, this kit is built to help you start confidently. Join the thousands of successful coffee entrepreneurs who started with a dream and a great plan. Your journey to coffee shop greatness begins right here!

Comprehensive. Proven. Affordable.

The Professional Coffee Shop Startup Kit

(Instantly Delivered To You)

* The information on this page is for educational purposes only. We do not offer legal or investment advice.