How to Form Your Coffee Shop LLC

How to Start a Coffee Shop LLC

How Do I Get an LLC for My Coffee Shop?

The Business of Starting a Coffee Shop

Need to set up a coffee shop LLC?

Need to set up a coffee shop LLC?

Starting a coffee shop LLC can seem overwhelming at first. It does require taking specific essential steps. Many new coffee shop owners often don’t know where to begin and which questions to ask.

You’re not alone!

In this post, we’ll discuss the process of opening your business and getting your Coffee Shop LLC in a snap.

Forming a New Coffee Business Business

Every new business, including coffee shops, must be registered and formed legally to operate as a recognized business entity.

Usually, this is done within your state and where you operate your coffee business. Every state has a specific agency that registers or accepts articles of incorporation – or certificates of incorporation – for businesses. This responsibility falls on the secretary of state’s office in most states.

Undergoing the registration process ensures that the state officially recognizes your coffee shop as an active business in good standing. This entitles you to legally do business in that jurisdiction for a given period, usually a year.

![]()

How Do I Get an LLC for My Coffee Shop?

Definition: What is an LLC?

An LLC stands for “Limited Liability Company.” An LLC is one type of business structure often used by single-member owners or multiple owners. It legally creates a separate legal entity apart from the individual that makes it.

This separation has a variety of benefits for its members. Once formed, the LLC, like a corporation, can be bought and sold and establish its own credit and debt. It can also protect its members’ personal assets.

Do You Need an LLC for your coffee shop?

Coffee shop business owners can create various business structures depending on the scope and type of coffee business they plan to operate. So, in essence, you don’t need an LLC to operate a coffee shop. However, you'll probably want to establish your coffee shop as an LLC or something similar. Fortunately, there are plenty of real benefits to having a coffee shop LLC, and the process is quite easy. Because of the benefits and ease of setting it up, it appears to be the favorite mode of many independent coffee shop owners.

Benefits of setting up an LLC:

Benefits of setting up an LLC:

- Limited responsibility

- Protects personal assets

- Easy to form

- Management flexibility

- Taxation flexibility

Whether you need an LLC or not is up to you to decide based on your business type. For example, you may choose to create a corporation, a non-profit coffee organization, or a sole proprietorship coffee shop. There may be reasons for each of these types of business entities. Making sure you choose the best one for you and your coffee business will be essential.

You should research every business structure type and seek the consultation of business partners, investors, and your accountant.

There are a few other business structures that you can set up:

- Corporation

- Sole Proprietorship

- Non-Profit

- Partnership

You can create a partnership also through an LLC. These are called multiple-member LLCs. For example, you will have a single-member LLC if you own the coffee shop alone.

Can I form an LLC in a different state?

Yes. Typically, if you operate a coffee business in one state, you’ll want to create an LLC within that particular state. However, it is very common for a business to be established as an LLC in one state and operate in another.

For example, let’s say you create a coffee shop LLC in the state of Virginia. Then, you can operate your second location in Maryland, a third in the District of Columbia, etc.

While you may not have to create a separate LLC in each state you operate in, you may still need to register your business in those other states. Additionally, you will need to get the appropriate licenses and permits to operate your coffee shop in those locations as well. And finally, you will need to pay taxes and other fees in each jurisdiction.

You Can Create an LLC in Minutes

It’s easier than ever to create a coffee shop LLC. Today, most states and territories set up your LLC in a snap online.

Usually, this is done through the state’s secretary of state office. However, many SOS offices have made it easy to apply and submit your articles of incorporation (or certificate of incorporation) online and maintain your account.

You need to visit your state’s secretary of state’s website, where you most likely need to create an account.

Further Reading: Requirements to Start a Coffee Shop

Steps to Creating an LLC

What You’ll Need to Setup Your LLC:

- Prepare & Research

- Choose a coffee shop business name

- Select a registered agent

- Have an operating agreement

- Be mindful of your privacy

- Select a state

- Apply for Your EIN

- Maintain Your LLC

Prepare to Create Your LLC

Before applying for your coffee shop LLC, It is best to gather all the necessary items and information.

I recommend visiting your state’s SOS site and determining what information you’ll need, including the costs. Each state may have similar but different informational requirements.

Choose your Coffee Shop Name

If you haven’t already done so, consider choosing a name for your coffee business (You will be asked to submit a business name). Additionally, you may want to select a “DBA” – or “Doing Business As.”

For example, while your Coffee Shop LLC name might be “Los Angeles Coffee, Tea, & More,” your DBA may also be “LA Coffee Works.”

Of course, you must ensure that the name isn’t taken and that you are not violating anyone’s trademark.

Choose a Registered Agent

When creating an LLC, you must have a registered agent. Your registered agent is an honest individual responsible for correspondence, maintaining records, updating any pertinent information with the secretary of state’s office, and paying annual fees.

Your registered agent will need to provide their name, address, and phone number. You can hire a registered agent, select a registered agent service, or be your own registered agent for your LLC. In other words, you can be your own registered agent. Keep in mind that a registered agent's information will be made public.

Further Reading: Why You Should Create a Coffee Shop LLC Operating Agreement

How to Start a Coffee Shop LLC

Have an Operating Agreement

Not every state requires an operating agreement. However, it is essential that if you have more than one member, an operating agreement should be drafted and signed by all members.

Your operating agreement, among other things, proves the company’s ownership. You may elect to state the percentage of ownership of each member expressly. Therefore, it is essential to list the names, addresses, and percentage of ownership.

Additionally, your operating agreements spell out your coffee shop’s rules, procedures, and positions of company ownership. This may further affirm your limited liability in case of a legal battle.

Construct your coffee shop operating agreement in a way that seeks to provide a process to deal with future disagreements and conflicts. For example, you will want to make sure your operating agreement determines who gets to make the final business decisions.

An operating agreement often spells out the following:

- Member information

- Membership percentage of ownership

- How memberships are transferred

- Initial investments

- Salaries and compensations

- Decision-making procedures

- Members leaving or selling their stake

- Company dissolution

- Breakdown of member obligations

Be Mindful of Your Privacy

It’s important to state that your information will be made public. Whatever information you submit with your LLC application is now open for scrutiny – name, address, email, and phone numbers will all be available. The chances are that you’ll get tons of solicitations, unwanted mailings, and unsolicited calls. Be wary of bogus services offered by companies. It is often recommended that your company rents a physical post office address prior to submitting your LLC paperwork.

Select your State

Often, you will live, work, and open a coffee business in the same state. But this isn’t always the case. For example, you can live in Illinois but open a coffee shop in Indiana.

Therefore, select the state of incorporation that works best for you and your business, and file your articles of incorporation with your preferred state. However, be sure you know the obligations of each jurisdiction you intend to do business in.

Get Your Coffee Shop EIN

When you apply for articles of incorporation (AKA your certificate of incorporation), you will want to use it to receive your Employer Identification Number (EIN).

An EIN is also commonly known as a Federal Tax Identification Number. It’s free to get, and you can get it instantly at IRS.gov.

You are required to have an EIN if you:

- Intend to hire employees

- Operate a business as a corporation or partnership (includes LLCs)

- File any employment tax returns

- Withhold taxes

- Have a non-profit

Note: Some states will provide you with an additional business identification number. For example, in Washington state, the Secretary of State’s office offers a UBI or Unified Business Identifier. This allows your business to interact with a variety of important state agencies. Consider researching whether your state requires you to get an additional identifier number.

Are You Ready?

If you've gathered the information we've noted above, you're well on your way to getting your LLC formed. Next, you will want to search for the Secretary of State website in your state and set up an account. Be prepared for administrative fees for your LLC.

Further Reading: How To Start a Coffee Shop Successfully

How to Start a Coffee Shop LLC

Maintaining Your Coffee Shop LLC

Now that you’ve applied for your LLC paid your fees, and have your LLC letter in your possession, you can start your business.

But remember that your LLC needs to be maintained by your state and federal government regulations.

This means keeping your registered agent information and company information updated and paying regular renewal fees.

Your LLC Tax Implications

After you get your Coffee Shop LLC, you will be able to pay your federal income taxes. Your EIN will allow you to fill out the necessary forms and submit any payments.

Trending Articles on Coffee Shop Startups:

Coffee Shop Ideas & Concepts Coffee Shop Budget and Planning

50 Coffee Shop Ideas & Concepts 7 Ways to Open a Coffee Shop with No Money

Low-Cost Coffee Shop Ideas Open a Coffee Shop Bookstore

How to Open a Drive-Thru Coffee Stand How Much do Coffee Shop Owners Make?

![]()

Open a Coffee Shop LLC

How Do I Get an LLC for My Coffee Shop?

Additional Questions:

Which business structure is better: LLC or Sole Proprietorship?

Ultimately, you will have to decide on the best business structure that works for your business. For example, many coffee shop owners gravitate towards an LLC because of the financial protections and practical benefits an LLC affords. On the other hand, a sole proprietor business is helpful in certain companies and industries but may fall short of the business needs of a coffee shop or other retail business.

What does limited liability mean?

Having an LLC protects you from risking your assets, money, and property. If you or your company gets into a legal pickle – and your actions occurred during a regular business operation – you may have some protection.

Please note that we are not providing legal advice.

You’ll want to check with an attorney about any specific problems you may encounter in the ordinary course of doing business.

What is a single-member LLC Vs. a multi-member LLC?

A single-member LLC means that the business is owned and operated by one person, namely you. That means you make all the decisions about the ownership and operation of the coffee shop.

A multi-member LLC or partnership means that more than one member owns the business.

What is an S-Corporation?

S-Corps and LLCs are similar in that they offer protection for members or shareholders. The S-Corp status typically refers to the tax status of a corporation, which may include an LLC.

Like a regular LLC, S-corps allow companies to pass their income or losses directly through their members’ or shareholders’ income. This helps members or shareholders avoid double taxation.

Your coffee shop can be an LLC and an S-Corp in some cases. However, the IRS has specific guidelines for qualifications.

If a new company has many shareholders (but less than 100), it might often consider setting up with an S-Corp tax classification. On the other hand, many single-member LLCs or those businesses with few partners will want to elect to have a regular LLC partnership over an S-Corp because it may be more cumbersome to maintain. To get S-Corp status, you must first open a coffee shop LLC. In either case, you'll want to research to see which legal and tax structure works best for your coffee shop.

Open a Coffee Shop LLC

Your Coffee Shop LLC

Got Your Coffee Shop LLC: What’s Next?

If you’ve applied and received your state’s letter of incorporation, it’s time to get down to business.

Make sure you get your EIN. It's free and easy to obtain. Next, you’ll want to open a bank account in your business’s name. This will help you streamline your finances into one business account.

Open up necessary business accounts with your state agencies to pay for taxes, fees, and renewals. Often, this is done through the state's Department of Revenue, the state's secretary of state office, and other licensing agencies.

I recommend that you embrace your paperwork, keep reminders on your calendar of when to submit future items, utilize a bookkeeper, and stay organized.

Ready to Get Started?

Start Your Dream Coffee Shop Business

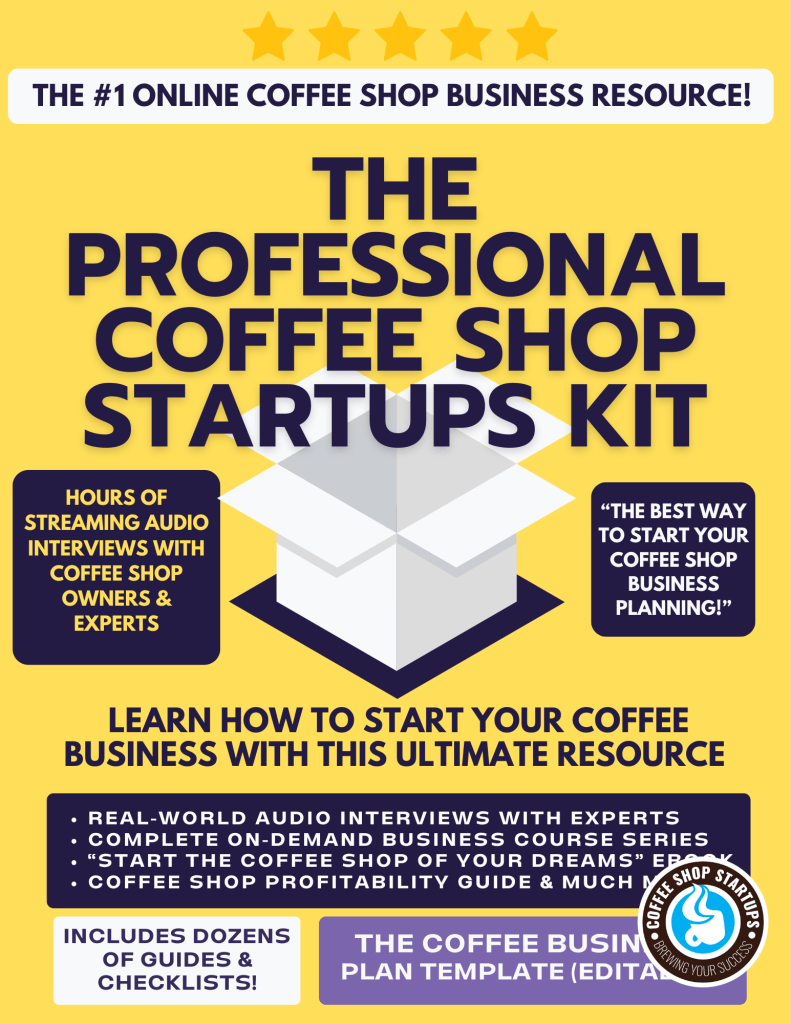

Starting a coffee shop is exciting, but it can also feel overwhelming. Where do you start? What steps should you take? How do you avoid costly mistakes? That’s where the Professional Coffee Shop Startups Kit comes in. It’s designed to give you a clear, practical roadmap to opening a successful coffee business—without wasting time or money on guesswork.

Inside, you'll find:

![]() Expert interviews with real coffee shop owners and business experts.

Expert interviews with real coffee shop owners and business experts.

![]() An On-Demand 37-lecture course covering everything from business planning to daily operations.

An On-Demand 37-lecture course covering everything from business planning to daily operations.

![]() Editable coffee shop business templates, financial documents, checklists, and planning tools to keep you on track.

Editable coffee shop business templates, financial documents, checklists, and planning tools to keep you on track.

![]() A step-by-step startup guide that walks you through concept development, permits, branding, and more.

A step-by-step startup guide that walks you through concept development, permits, branding, and more.

![]() Cost-saving strategies to help you launch your coffee business on a budget.

Cost-saving strategies to help you launch your coffee business on a budget.

Whether planning a small coffee cart or a full-scale café, this kit is built to help you start confidently. Join the thousands of successful coffee entrepreneurs who started with a dream and a great plan. Your journey to coffee shop greatness begins right here!

Comprehensive. Proven. Affordable.

The Professional Coffee Shop Startup Kit

(Instantly Delivered To You)

* The information on this page is for educational purposes only. We do not offer legal or investment advice.