Your Mobile Coffee Truck Funding Mix

Your Mobile Coffee Business Guide

Your Mobile Coffee Truck Funding Mix

Do you want to start a coffee truck but might be unsure about the costs?

Paying for your coffee truck or coffee trailer can be a substantial barrier, but with the right planning, it doesn’t have to. In fact, many of the financial barriers that often exist with starting a mobile coffee business are mainly due to many of us not facing the costs upfront and then figuring out a solid way to get the funds.

In this post, I want to discuss one of the best ways to overcome the financial barrier of starting a coffee truck: creating a coffee truck funding mix. I used this method when starting my coffee trailer and advocated for others to do the same.

Planning a solid way to access money to start your coffee truck business comes down to planning and strategy. This is what I intend to discuss in this post. Additionally, I’ve written about developing a coffee shop funding mix in the past and found that it is a very helpful tool.

So, let’s get started.

![]()

How to Fund Your Coffee Truck

What Is a Coffee Truck Funding Mix?

Finding the money to start a coffee truck can sometimes be intimidating. It was for me. But that's the beauty of developing a funding mix – it reduces stress and anxiety because it breaks things down in an easy way to develop your financial plan.

A coffee truck funding mix is a framework that helps you determine where you will get your funding. In other words, it lays out precisely where you will get the money to set up your coffee business. It consists of realistic funding pools.

It allows you to see where you will get the funding and the percentages that each pool will provide.

Why A Coffee Truck Funding Mix?

A funding mix helps you better understand how to obtain the funds needed to start your coffee truck. It breaks down each funding source so that you can develop a comprehensive strategy for obtaining those funds.

This simple funding framework can be a powerful tool in demystifying the costs of starting a coffee truck. It shrinks the “illusionary” wall between us and our profitable mobile coffee business.

Funding Your Coffee Truck

Steps to Developing Your Coffee Truck Funding Mix

Figuring out how to pay for your coffee truck isn’t rocket science. However, it can still be a big enough challenge that many people don’t even try.

Yet, by taking 15 minutes to develop your funding mix, you’ll be tearing down that wall and on your way to figuring out your path forward.

So, here are a few simple steps to getting your funding mix

Step 1:

Develop a Mobile Coffee Truck Budget

Developing a coffee truck funding mix is actually the easy part. The most thoughtful part is developing a realistic coffee truck startup budget.

Having a budget before moving forward will save you time and money. A budget that fits in with your larger business plan will help you articulate your vision, mission, and plan moving forward.

A budget will consist of your estimated expenses and help you understand how much money you need and why.

I’ve written extensively on developing your coffee shop business budget, which you may want to check out. After you develop your coffee truck business plan and budget, you'll then want to create your funding mix.

Step 2:

List Your Potential Pools Within Your Funding Mix

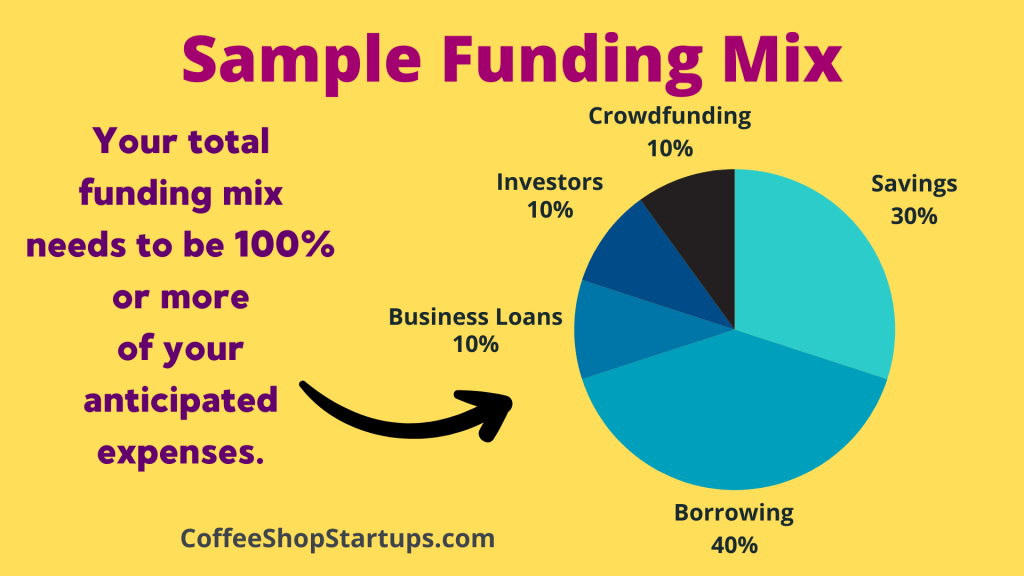

The following are several major pools of funding that you may want to utilize for funding. Ideally, the percentage you utilize should equate to 100% or more of the funds you need.

A quick note: Everyone will have their own funding mix. Your funds can come from anywhere– from your savings to a gift from a relative. Everyone’s story mix will be different. And that’s okay.

Further Reading: Coffee Truck Ideas

The following pools are followed by some thoughts on each of them:

Personal Savings

Your savings will likely be your first pool of funds.

To get your coffee truck planning off to the right start, it’s important to bring your own money to the table. While you might not have all the funds upfront to launch your coffee truck, you should plan on a certain percentage of your mix originating from your savings.

I recommend putting at least 20% of your savings into your coffee truck business. This money will provide the necessary initial seed money to get things off the ground. This may include initial research, setting up your coffee business structure – such as an LLC, and other initial costs.

Providing at least 20% of the funding tells other partners, investors, or loan providers that you have skin in the game – and that you are serious about moving forward with your business. A loan officer or potential investor may feel more confident investing their money, knowing that their money doesn’t provide 100% of the initial investment.

Family and Friends

Utilizing family and friends to help fund your business has many benefits. Often, families and friends are willing to help and loan you money and are willing to help. Funds originating from family and friends can help you avoid the higher scrutiny of bank loan processes, credit checks, and higher interest rates and fees.

Nevertheless, I recommend that any financial assistance be noted in a written contract. If you treat your coffee truck business like a business, you’ll want to have a loan contract that details the amount of the loan, when payments are scheduled to be made, and what interest will be included—as well as anything else that is important. Something in writing—even with your friends and family—affirms your professionalism and seriousness.

Bank Loans

After your initial investment from your savings, family, and friends, you may opt to try to get a small business bank loan. There are some benefits to getting a bank loan, especially if you cannot get the assistance of friends and family. A business loan is often cut and dry and can provide a straightforward way to get the cash you need. This can help you avoid any entanglements that you may seek to avoid when working with family or friends.

Home Equity

Some of you might have the option to utilize your home equity for additional funds through a home equity loan or a home equity line of credit. These options offer different paths to obtaining money and should be discussed with your family, partners, and tax advisors. That said, they both offer another potential financial pool to fund your coffee truck startup – and in some cases, it might be an ideal way to fund your coffee truck business fully or partially.

Partners

It is common for coffee truck operators to have partners. That’s because partners can bring many great benefits, including much-needed capital. In addition to bringing a partner into the business, you can divide up the costs and responsibilities. This can have a positive effect on reducing your financial barriers.

If you do have partners in your coffee truck business, I highly recommend collaborating to create an operating agreement that works well for all partners.

Investors

Investors can be a key part of your coffee truck funding mix. Investors differ from partners in that they are less likely to be involved in the day-to-day operations. They may require other concessions in addition to their interest and principal. However, many investors may take a hands-off approach to the daily tasks. Still, it’s important to ensure that you have a clear agreement with terms written and signed.

Crowdfunding

Crowdfunding your coffee truck is a viable option. This type of funding can bring in significant capital to jump-start or help you reach your financial goals. Crowdfunding has been particularly popular over the last few years and can be used to provide significant weight to the overall funding ratio. But don’t be fooled; crowdfunding takes both work and investment before and after you run your campaign.

Your Coffee Truck Funding Mix Percentage

As I mentioned earlier, you will want to make sure that your pools of funding are at least 100% or more of your needs. I recommend having more than 100% of your requirements because one or more of the funds may not provide your anticipated money.

Utilized the funding pools above your sample funding mix can look like the following:

- Savings: 30%

- Friends and family: 25%

- Home equity: 5%

- Bank loans: 20%

- Partners and Investors: 10%

- Crowdfunding: 10%

Of course, you’ll have your unique balance within your funding mix.

How to Pay for Your Coffee Truck

What Comes Next?

After developing your funding mix, you will want to develop surefire strategies to help you reach your percentage target from each pool. This might be revising your coffee truck business plan template and offer a proposal to each funding source – your parents, friends, partners, or bank institutions.

Funding Your Coffee Truck Conclusion

Ultimately, there are a lot of advantages to starting a coffee truck business. The lower costs of a traditional brick-and-mortar store are one of them. However, that advantage can get away from you if you don’t prepare. In fact, preparing for your coffee business will help you reduce your startup costs and better ensure your successful launch.

![]()

ORDER TODAY

The Ultimate Mobile Coffee Business Ebook

Successfully Plan and Start Your Mobile Business

* The information on this page is for educational purposes only. We do not offer legal or investment advice.